Private Investor Access — CIVI.ai Holding Company Seed Raise

CIVI.ai — The Veteran Placement Engine Housing. Jobs. Outcomes.

Powered by InVETment Capital, we are building a repeatable placement system designed to verify, match, place, and retain veterans in housing and employment outcomes.

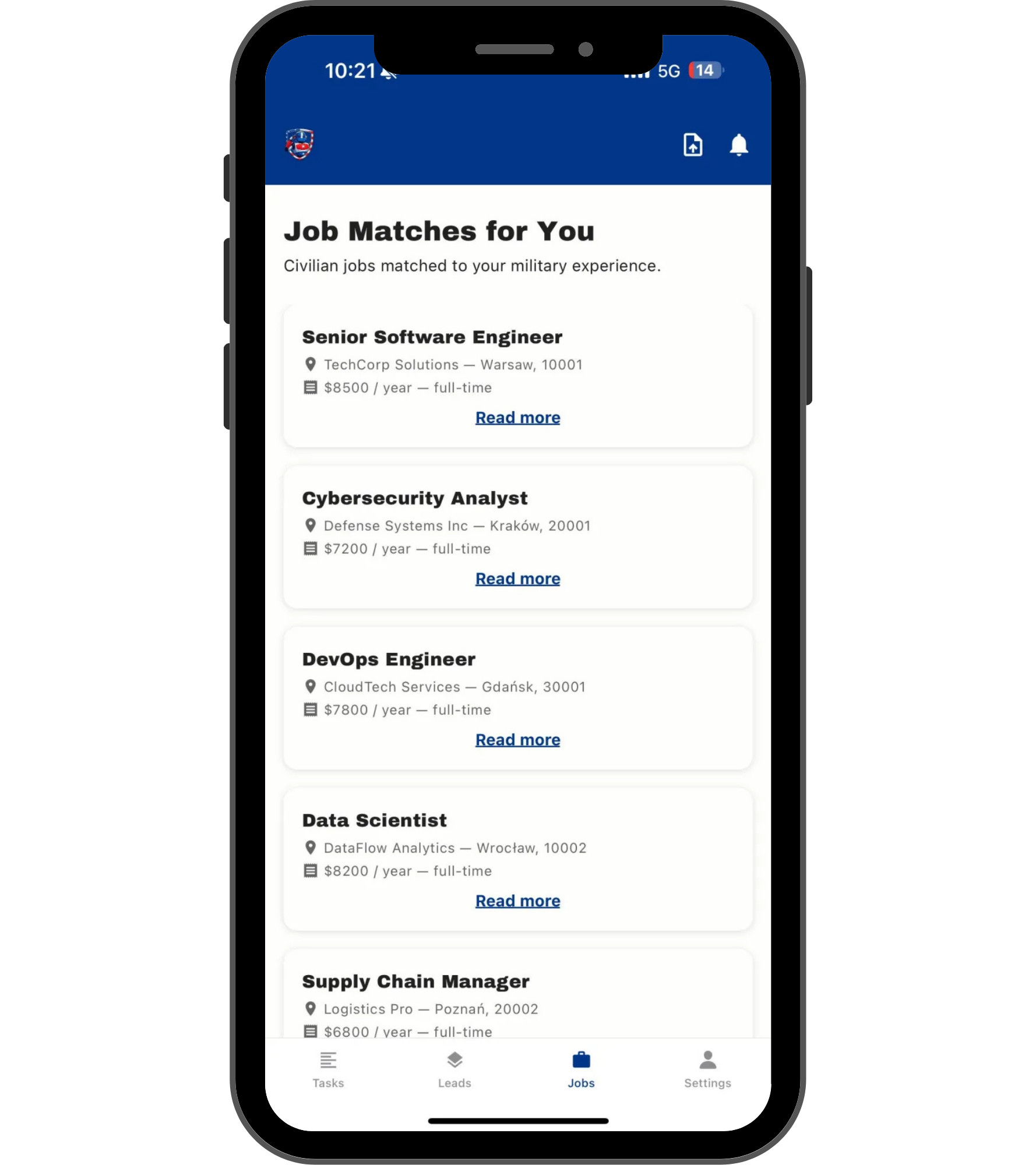

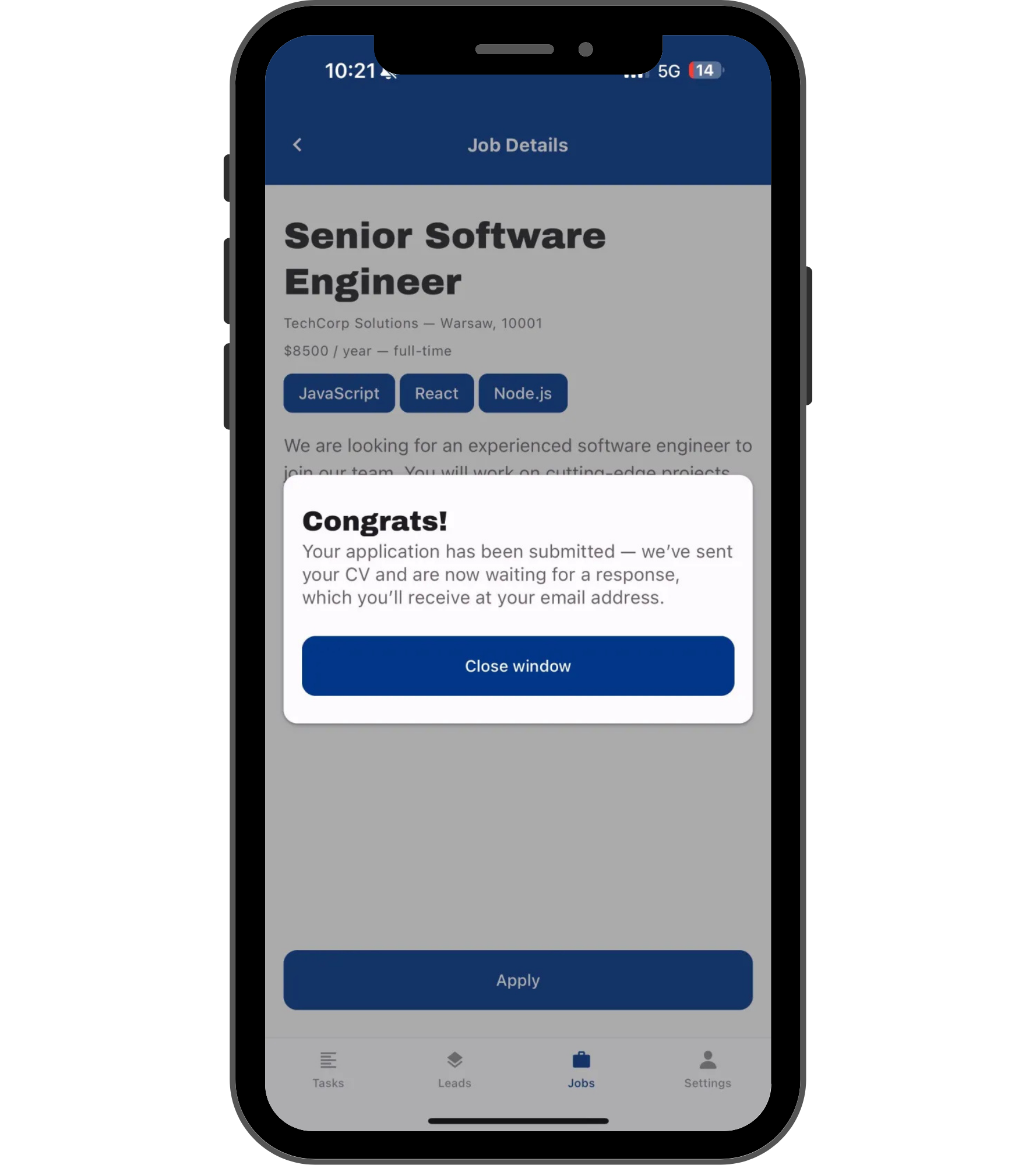

Product

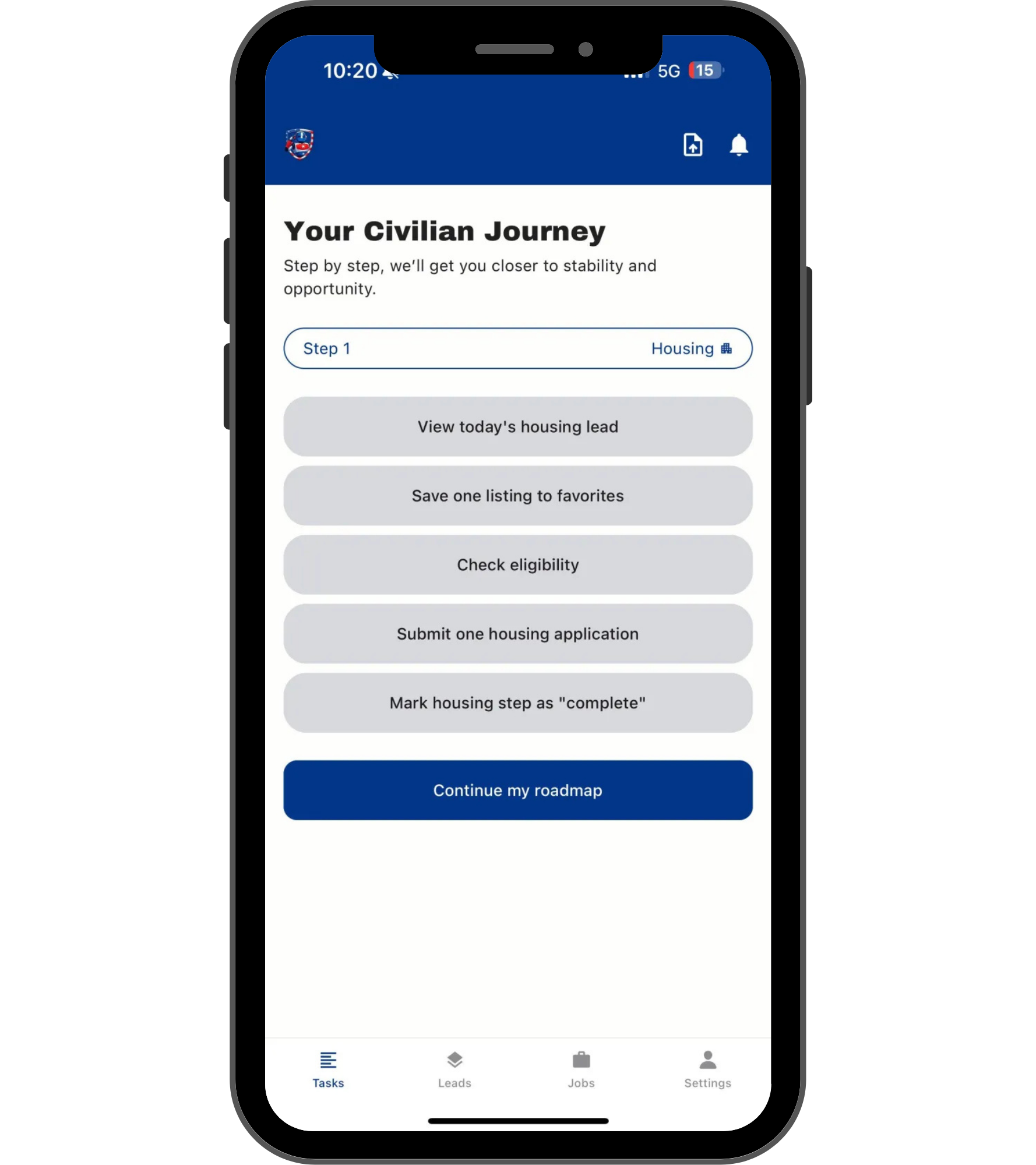

Phase 1 MVP placement workflow connecting Veterans, Partner Housing, Employers, and Vetted Support Partners.

Revenue Engine

Housing placements (10% rent-share) + Job placements (10% success fee on verified hire + retention).

Raise

$500,000 Convertible Note • 10% interest • 3-year term • Convertible to equity.

Investor Briefing Kit

Get the Investor Brief + Deck + KPI Snapshot

Verified access only. Complete the prequalification form to unlock the investor brief, pitch deck, KPI snapshot, and data room access (post‑verification).

Verification powered by Harmonious (KYC/AML + accreditation).

Video Sales Letter

Vision + Mission Overview

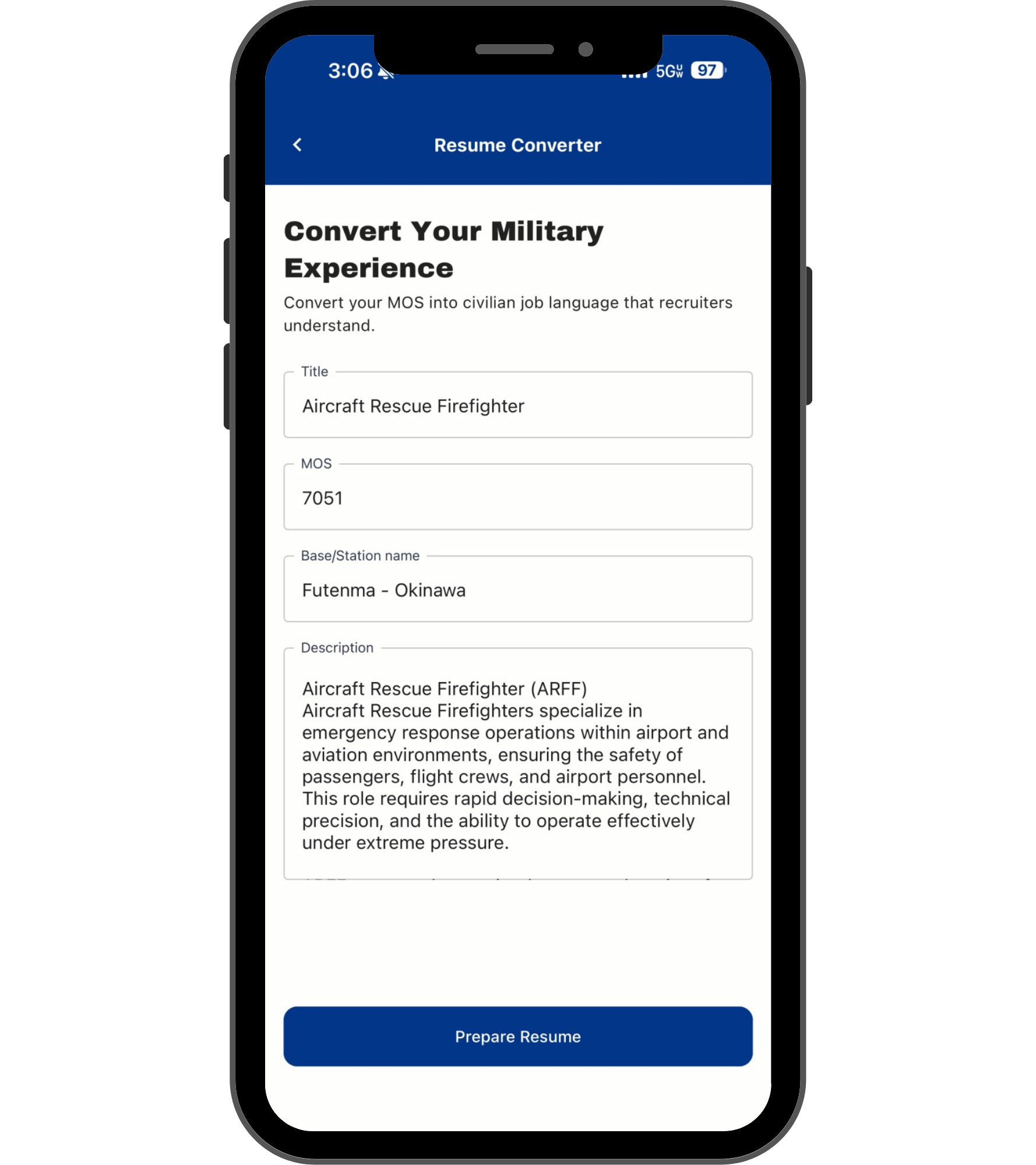

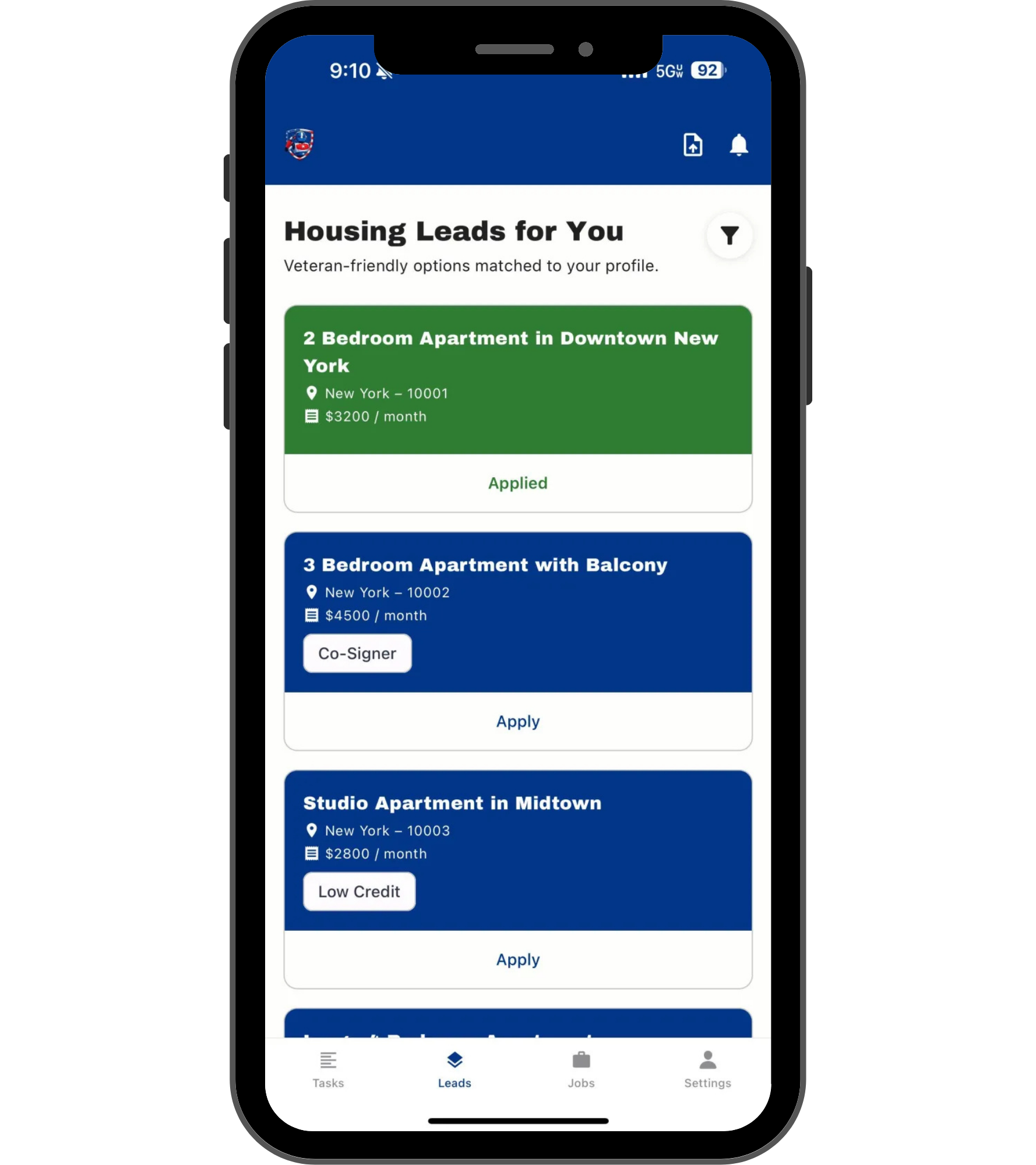

Product Vision Overview

Swipe through the CIVI.ai experience and core screens.

Tap through the CIVI.ai experience screens.

Two Engines. One Flywheel.

Real estate inventory feeds placements. Placements improve NOI and unlock more deals.

Engine 1 — Asset Engine

InVETment Real Estate Syndication

- Equity participation & gains (deal upside)

- Cash flow participation (operating distributions)

- Targeting ~20% JV equity position in each JV deal

Engine 2 — Platform Engine

CIVI.ai Placement Platform

- Housing placements: 10% rent-share while occupied

- Job placements: 10% success fee on verified hire + retention

- Outcome tracking + compliance baked in

The Seed Raise

$500,000 Convertible Note to complete Phase 1, scale distribution, and prove placement velocity.

Terms Snapshot

- 10% Interest

- 3-Year Term

- Convertible to Equity

- $50,000 ≈ 1% ownership (InVETment Capital / CIVI.ai)

Use of Funds

Balanced allocation to build, distribute, and scale outcomes.

What We Will Measure

Phase 1 exit criteria are investor-grade execution metrics.

Placement Velocity

- Verified leads entering the system

- Leases + hires per month consistently increasing

- Flywheel impact across housing + employment partners

Speed

- Time-to-lease trending down

- Time-to-hire trending down

- Reduced friction from intake to placement

Retention

- 90-day stability signal per cohort

- Lower churn across housing and employment

- Improved outcomes for veterans + partners

Economics

- Revenue per placement trending up

- Early CAC payback trajectory

- Improved unit economics from repeatable outcomes

Who This Is For

We want aligned investors who value execution and verified outcomes.

This is for you if…

- You invest in execution-driven companies with measurable milestones.

- You like models where revenue is tied to completed outcomes.

- You prefer verified access and clean compliance (506(c) process).

This is not for you if…

- You want public term sheets without verification.

- You’re looking for guaranteed returns or passive narratives.

- You’re unwilling to complete accreditation verification.

Investor FAQ

Clear answers before you verify access.

What is CIVI.ai?

CIVI.ai is a placement and workflow engine that connects veterans with verified housing, employers, and vetted support partners to drive repeatable outcomes.

What are you raising?

$500,000 via convertible note (10% interest, 3-year term, convertible to equity).

How does verification work?

After requesting access, investors complete KYC/AML and accreditation verification through Harmonious before receiving full offering materials.

When do I receive the data room?

Data room access is shared after verification and approval.

Who is eligible?

This offering is for verified accredited investors only (Reg D 506(c)).

Are returns guaranteed?

No. This is a private offering with risk. Full terms and risk factors are provided after verification.

Here’s Exactly What Happens Next

One path forward. Verified access only.

Request Investor Access

Submit your details to begin the process.

Verification (506c)

Complete the Harmonious KYC/accreditation workflow.

Intro Call + Data Room

Once verified, receive access to the call and materials.